Mortgage borrowing ratio

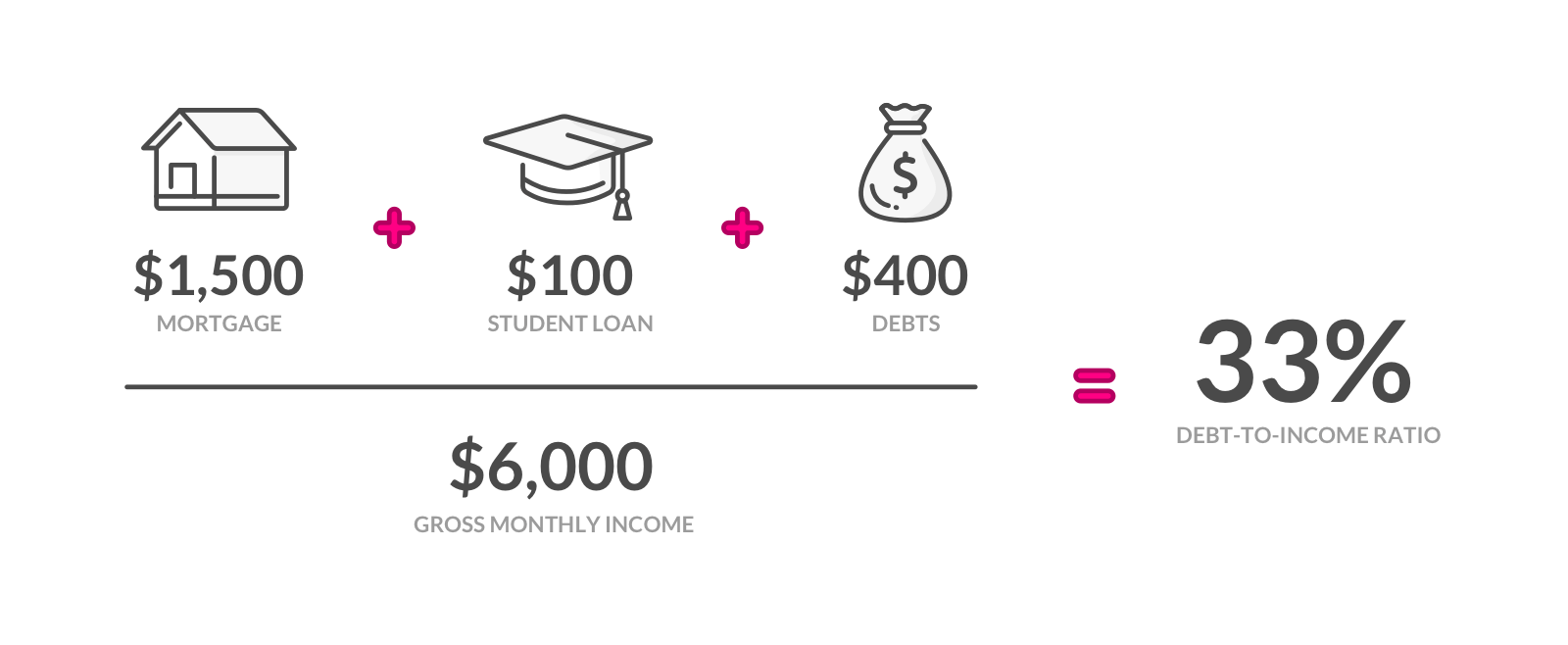

This drastically affects how much they can borrow for a mortgage. Borrowers may go up to DTIs of 44 if their front-end ratio is below 32.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Ad Mortgage Rates Have Been on the Decline.

. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Find the Best Mortgage Lender for You. Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

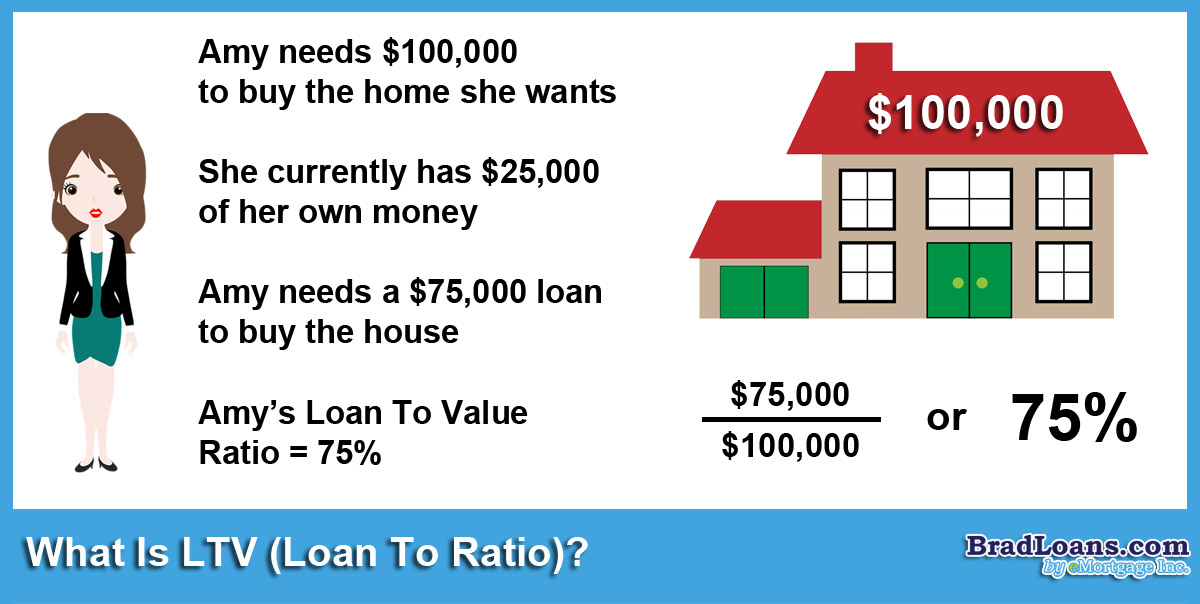

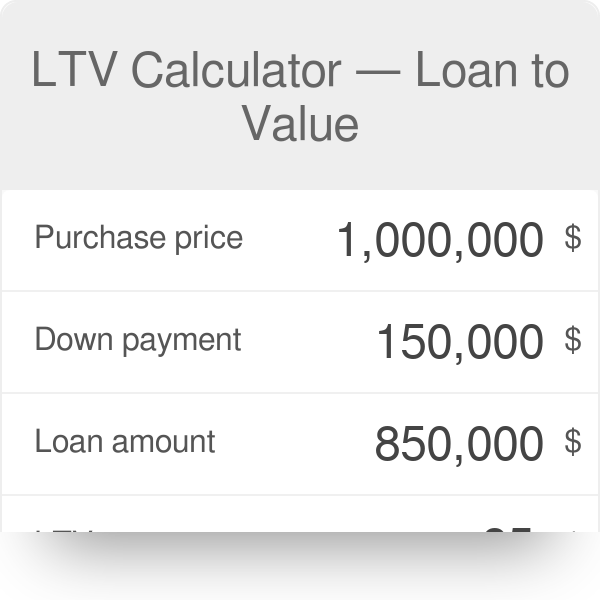

Compare Best Mortgage Lenders 2022. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. Lock Your Mortgage Rate Today.

Compare Offers Side by Side with LendingTree. This ratio compares the amount you hope to borrow with how much the property is worth. As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Ad Mortgage Rates Have Been on the Decline. - SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. Your front-end or household ratio would be 1800 7000 026 or 26.

Lending ratios exist to conduct credit and financial analysis of potential borrowers before loan origination. If your credit score is. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Get Preapproved You May Save On Your Rate. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Say for instance you pay.

Typically the higher your deposit the lower your LTV. Note both loans aim for a 36 DTI which is typical for a conventional mortgage. If you have an extremely low debt-to-income ratio you may be able to borrow as much as 89 percent.

For example if your monthly pre-tax income is. They include the debt-to-income ratio the housing expense ratio and. If your credit score falls between 500.

Ideally lenders prefer a debt-to-income ratio lower than 36 with. Apply Online Get Pre-Approved Today. The Loan to Value Ratio LTV shows how much equity you have in a house relative.

Whats an Ideal Debt-to-Income Ratio for a Mortgage. Ad Were Americas Largest Mortgage Lender. However many popular loans.

Ad Compare Your Best Mortgage Loans View Rates. In general you need a back-end DTI of 36 or lower. Means as of any date of determination the lesser of i the Maximum Amount and ii the Borrowing Base in each case less the sum of the Revolving Loan and Swing Line.

In the case of a mortgage it would mean that the. Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers. For homebuyers who are trying to qualify for an FHA loan an acceptable loan-to-value ratio is 965 if your credit score is at least 580.

A set of ratios that are used by lenders to approve borrowers for a mortgage. What More Could You Need. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Get the Right Housing Loan for Your Needs. Your debt-to-income ratio is a metric that your loan officer will use. The Loan to Value Ratio LTV is what financial institutions use to assess risk before approving a mortgage.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. To get the back-end ratio add up your other debts along with your housing expenses. The more you put toward a down payment the lower your LTV ratio will be.

When youre trying to take a loan against your mortgage borrow limits are. 6 Conventional loans. Get Preapproved You May Save On Your Rate.

The borrowers front-end ratio which is the total housing expense compared to the. A 70 070 loan-to-value LTV ratio indicates that the amount borrowed is equal to seventy percent of the value of the asset.

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

Mortgage How Much Can You Borrow Wells Fargo

Mortgage Ratios It S Not As Difficult As You Think Achroma

Debt To Income Ratio Formula Calculator Excel Template

Loan To Value Ratio Ltv Formula And Example Calculation

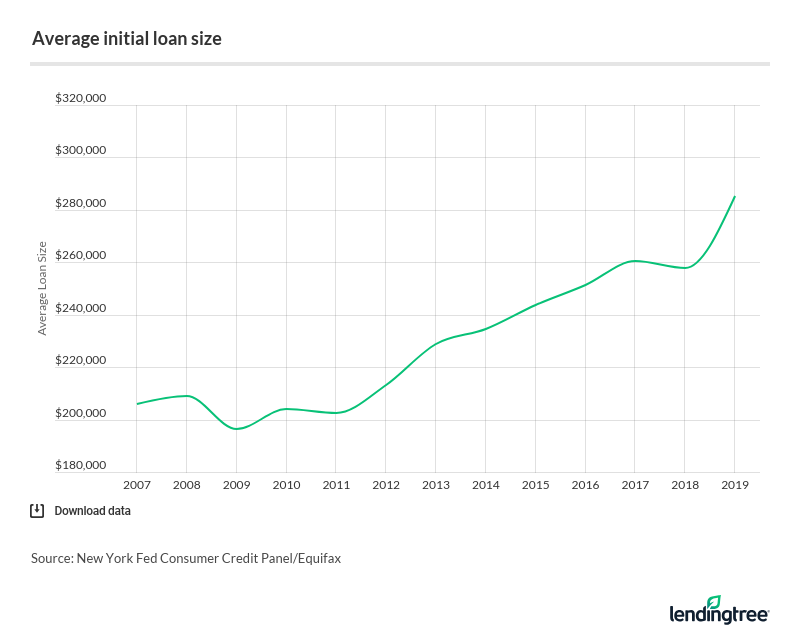

U S Mortgage Market Statistics 2020

Debt To Income Dti Ratio

What Is Ltv Loan To Value Ratio Brad Loans By Emortgage

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

How To Calculate Your Debt To Income Ratio Lendingtree

:max_bytes(150000):strip_icc()/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

How To Calculate Your Loan To Value Ratio Finder Com

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

What Is The Debt To Income Ratio Learn More Citizens Bank

Ltv Calculator Loan To Value

Fha Requirements Debt Guidelines

/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition